The Blast network has had a successful mainnet launch, with around 180,000 users withdrawing $400 million from the network. This is significant, especially considering that it unlocked billions of staked crypto for the first time. It will be fascinating to see how the network develops and grows in the future.

The withdrawal of around $400 million in Ether (ETH) from the Ethereum layer-2 network Blast after the launch of its mainnet on Feb. 29 at 9:00 pm UTC has indeed been a significant development. This withdrawal has unlocked nearly $2.3 billion in staked crypto that was previously locked up on the network.

Blast, as an optimistic rollup blockchain scaler, has garnered attention for offering users up to a 5% annual percentage yield on Ether and stable coins held on the network. This yield is generated from staked ETH and United States Treasury Bills (T-Bills) managed by the blockchain protocol and Dai.

The ability to earn yield on assets while they are staked on the network is a significant feature, attracting users to participate in the Blast ecosystem. With the withdrawal of funds and the subsequent unlocking of staked assets, it will be interesting to observe how Blast continues to develop and influence the world of blockchain and cryptocurrency. The promise of yield generation combined with the scalability benefits of optimistic rollup technology could potentially position Blast as a key player in the decentralized finance (DeFi) space.

it must have been frustrating for users to not have any means to withdraw their funds before the mainnet launch. The inability to access one’s funds can create uncertainty and anxiety among users, especially in the cryptocurrency space where security and control over one’s assets are paramount.

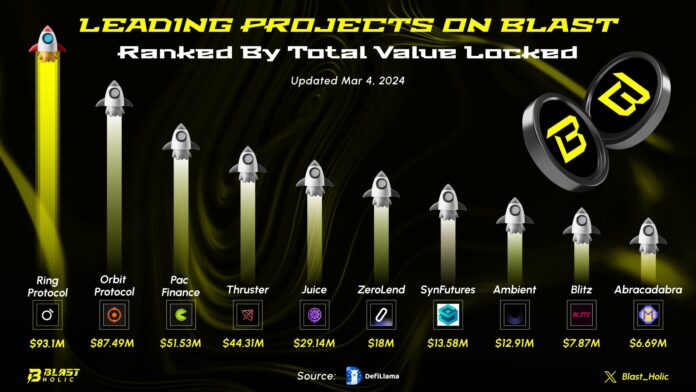

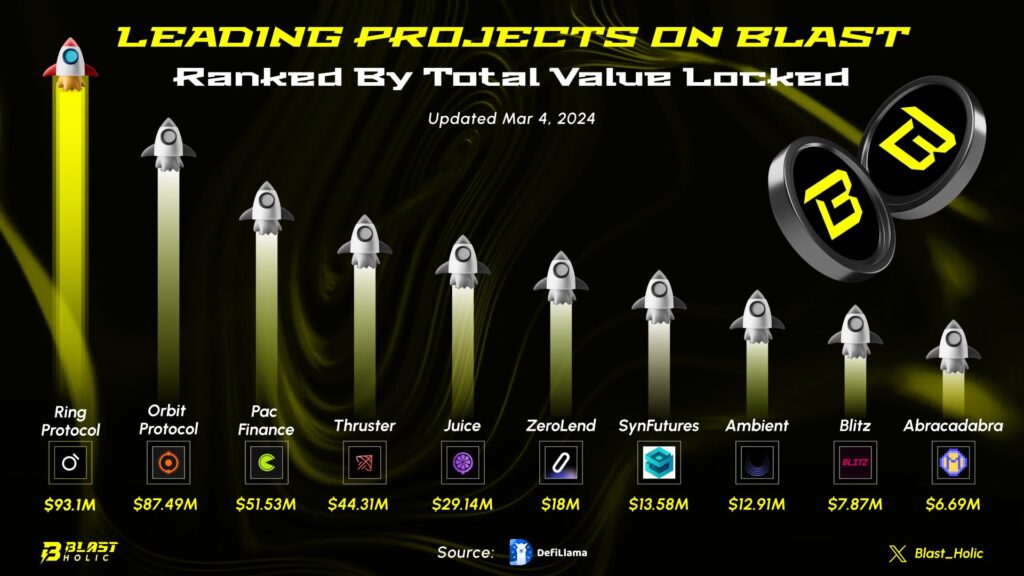

While it’s positive that users can finally access their crypto now, it’s unfortunate to see that Blast’s total value locked has decreased by 17.5% since its high on Feb. 29, with just under $400 million withdrawn after the launch, according to DeFiLlama data. This decrease in total value locked indicates a significant shift in the ecosystem, possibly reflecting changes in user sentiment, market conditions, or other factors.

It will be crucial for Blast to address any concerns that led to this withdrawal and to continue innovating and improving its platform to attract and retain users. Transparency, communication, and continued development will be essential in rebuilding confidence and maintaining a strong presence in the DeFi space.

Just before its mainnet launch on February 29, Blast reached a significant milestone by achieving a total value locked (TVL) of $2 billion for the first time, which was an exciting moment for the network. The attention of airdrop hunters has also been drawn to Blast, as they’ve started farming it in hopes of receiving Blast tokens that the team plans to release in May.

However, the launch of Blast hasn’t been without its controversies. Dan Robinson, who heads research at Blast seed investor Paradigm, expressed concerns in a post back in November. He mentioned that Paradigm didn’t agree with Blast’s decision to launch the bridge before the Layer 2 (L2) or to restrict withdrawals for three months. They believed that these decisions could set a negative precedent for other projects in the future.